- Client’s Motive :

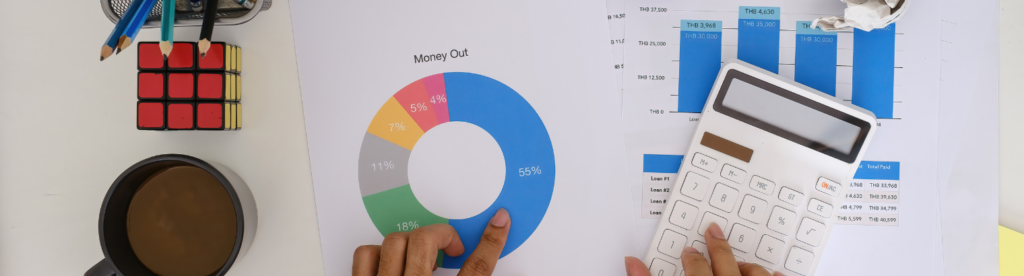

Obtaining comprehensive information about the client’s financial situation, investment objectives, time horizon, income, expenses, liabilities, and any other relevant personal and financial details so that optimal portfolio can be constructed. - Risk Factor :

Educating clients about the potential risk associated with different investments, ensuring they understand the potential upsides as well as downsides and are comfortable with the chosen approach. This coupled with Risk Tolerance Assessment (mentioned below) will enable build portfolios ranging from conservative to aggressive, with variations in between. - Risk Tolerance Assessment :

Evaluate the client’s willingness and ability to take on risks through a questionnaire that assesses their comfort level with market fluctuations, potential losses, and investment volatility. The questionnaire will cover topics such as risk perception, investment experience, and reactions to different scenarios. Thus, tailoring recommendations to the client’s psychological comfort. - Regular Review and Reassessment :

Risk profiling is not a one-time activity since the client’s financial situation and market conditions change, their risk profile may evolve. Thus, regular review and reassessing their risk tolerance, capacity, and objectives becomes paramount. - Documentation and Compliance :

Documenting the entire risk profiling process, including the client’s responses to the questionnaire, risk assessment results, and the rationale behind the chosen investment strategy. Since IA’s need to adhere to legal and ethical standards. When assessing and managing client risk, we will ensure that the risk profiling process complies with industry regulations and guidelines.

Investments in securities markets are subject to market risk. Read all related documents carefully before investing. Registration granted by SEBI, membership of BASL and Certification from National Institute of Securities Market (NISM) is/does in no way guarantee performance of the intermediary nor provide any assurance of returns to investor.

SEBI Registration No. : INA000018504

BASL Membership No. : BASL2082

CIN : U67100MH2022PTC377409

Multi Ark Wealth Private Limited

Unit No. 101, 1st floor, Simba Tower, CTS No.67-A/1, Village Dindoshi, Goregaon, Mumbai- 400063

Email ID : Support@ArkCaps.com

Landline No. : 022-50054266