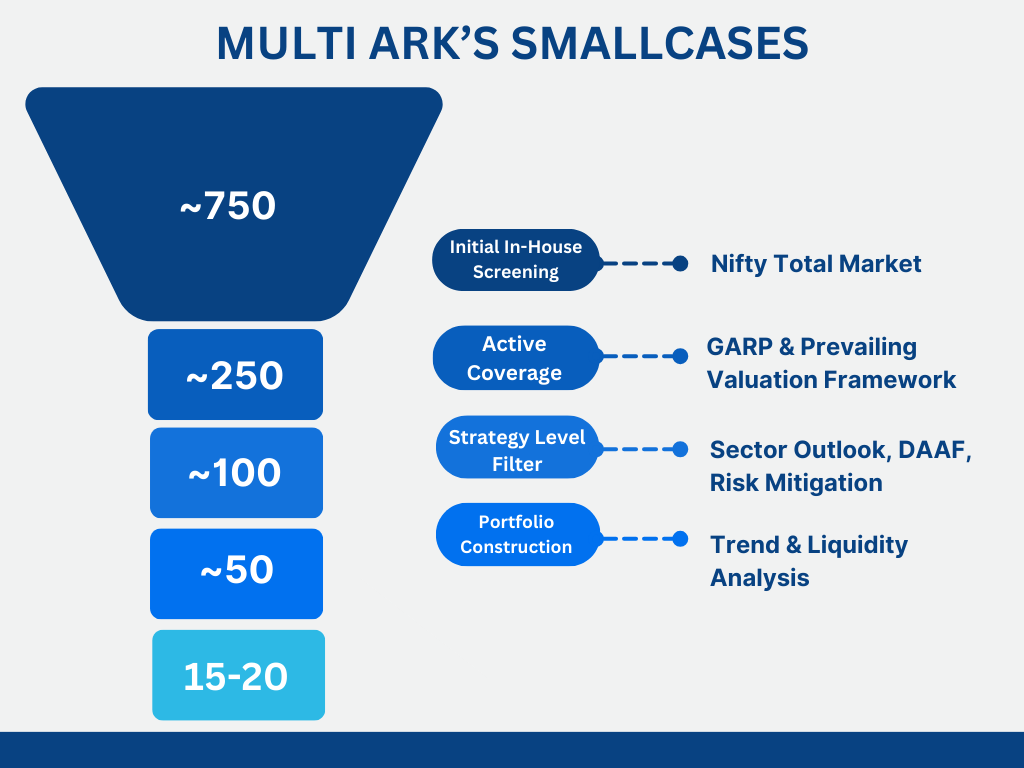

We have developed our in-house Proprietary Model that takes into consideration Growth, Quality of Earnings and the Management’s competence based on their track record. Thereby, trying to focus on those companies from the Nifty Total Market – TRI Index, that comes with a sustainable Moat.

We believe in ‘Price is what you Pay, Value is what you Get’; thus, we try building a diversified portfolio by focusing on companies that comes with reasonable valuations.

In the dynamic multi-facet market scenarios, taking Contra calls comes with high risk but also helps in generating even higher Alpha. Thus, Dynamic Asset Allocation is based on Sectoral rotation process as well as Strong Hands increasing exposure. Our final framework to arrive at a ~15-20 stock portfolio is derived from Trend and Liquidity Analysis that helps in risk mitigation.

Investments in securities markets are subject to market risk. Read all related documents carefully before investing. Registration granted by SEBI, membership of BASL and Certification from National Institute of Securities Market (NISM) is/does in no way guarantee performance of the intermediary nor provide any assurance of returns to investor.

SEBI Registration No. : INA000018504

BASL Membership No. : BASL2082

CIN : U67100MH2022PTC377409

Multi Ark Wealth Private Limited

Unit No. 101, 1st floor, Simba Tower, CTS No.67-A/1, Village Dindoshi, Goregaon, Mumbai- 400063

Email ID : Support@ArkCaps.com

Landline No. : 022-50054266